Getting paid Quicka with bank data

QuickaPay gives businesses access to better payment solutions and customers access to more flexible and affordable ways to pay and be paid.

Top-heavy bank sector holds back FinTech potential

A top-heavy banking ecosystem coupled with an under resourced regulatory regime is holding back Australia’s FinTech potential, according to industry leaders

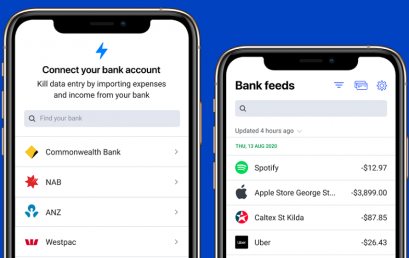

Connecting your bank for pay on-demand

Basiq has partnered with Cheq, a fintech aiming to put an end to the payday distress cycle by providing consumers with on-demand access to their wages.

Going solo with banking data

Access to banking data via partnering with Basiq will also allow Rounded to add features such as automatic reconciliation in the near future.

Open banking’s first loan approved

Leading Australian fintech company Basiq has worked with Regional Australia Bank to have the first loan approved under open banking.

ASIC & ACCC: Screen scraping is a valid method of data sharing

Basiq work with many fintechs and welcome the position that “digital data capture services,” like screen scraping, remain necessary to fintech development.

What open banking will look like for consumers

Basiq, a NAB Ventures, Salesforce Ventures and Reinventure backed open banking platform, reveals their first version of their CDR Consent Experience.

Thank You & Merry Christmas!

From the team at Australian FinTech, we’d like to say a massive THANK YOU to everyone who has supported us over the past 12 months.