Australian banks face a digital watershed moment

Legacy technology is currently preventing many banks from being able to adequately respond to technological advancements.

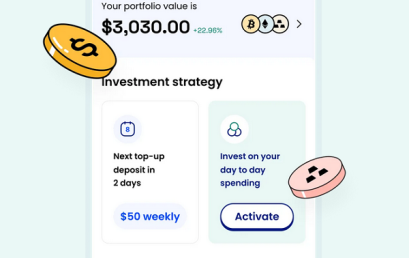

Bamboo unveils major App redesign: Empowering users to invest and save with ease

Bamboo, the leading micro-investing platform for crypto and digital assets, have announced the launch of its newly re-imagined app.

CreditorWatch appoints Ivan Colhoun as Chief Economist

Australian credit reporting bureau CreditorWatch have today announced the appointment of Ivan Colhoun as consulting Chief Economist.

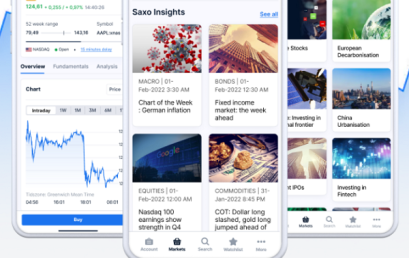

‘Keeping it simple’ has never been simpler: Global portfolio diversification a breeze with the upgraded SaxoInvestor app

Saxo Bank, parent of the wholly-owned subsidiary Saxo Australia, has launched its new and improved SaxoInvestor app.

Australian FinTech company profile #178 – Qikio Insurance

Qikio specialize in embedded insurance solutions with the groundbreaking goal of delivering seamless, questionless quoting.

Australia’s banks search for clarity in their complex digital operations

Caught in the crossroads of serving an older generation as well as a digitally savvy younger population, banks are responding in different ways.

Share trading platform Superhero shakes up investing with $2 brokerage

From today, Superhero customers will pay $2 brokerage per trade on all ASX trades up to $20,000 on the Superhero share trading platform.

2024 Financial Forecast: Trends and Changes in the Financial Services Sector

What does 2024 have in store for financial services organisations? Sandstone Technology cover regulatory changes, Gen AI, cybersecurity threats and more.