Neo-financial services platform WLTH launches, but don’t call them a bank!

The neo-financial services company, will launch with high ambitions for the market, with growth projections of $1.23 billion worth of loans by end of FY22.

Navag8 launches first Australian white label with the Credit Repair Group

Navag8 have launched the first Australian white label of their microsavings app with Credit Repair Group (CRA) in Sydney.

Sharesight portfolio tracker passes 150,000 users worldwide

Investors from over 100 countries are now leveraging Sharesight’s award-winning portfolio tracker to uncover the true performance of their investments.

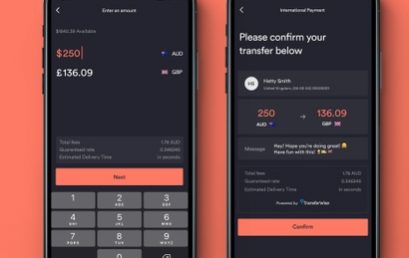

Digital bank Up launches international payments powered by TransferWise

Up announce that international payments powered by TransferWise has arrived. Now you can get a fast, easy and cheap way to move your money overseas from Up.

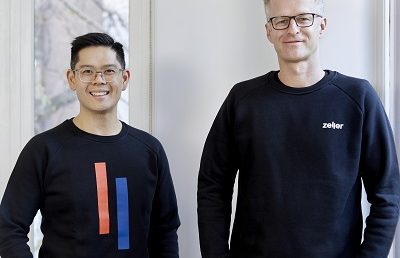

Australian fintech Zeller raises $6.3m to reimagine business banking

Former Square executives, Ben Pfisterer and Dominic Yap have unveiled Zeller, a new company focused on offering a true alternative to business banking.

Neobank 86 400 closes Series A capital raise taking total equity capital to $90m

Australia’s first smartbank, 86 400, has closed its Series A capital raise. $34m of new equity was raised in March, bringing its total capital to $90m.

Australian fintechs pull together to safeguard $1.8bn sector

Diversity and agility are two factors in Australian fintech’s favour as the sector battles to withstand the economic shockwaves from the global pandemic.

What open banking will look like for consumers

Basiq, a NAB Ventures, Salesforce Ventures and Reinventure backed open banking platform, reveals their first version of their CDR Consent Experience.