Credit card debt targeted by Douugh, financial ‘personal assistant’

Bank customers will soon be able to sign up for computer-generated tips on how to get on top of their credit card debt, manage their budget, and eventually, save money on their electricity bill. That is the ambition of start-up Douugh, a financial technology firm this month launching a pilot in Australia of a financial “personal assistant,” based on artificial intelligence. It is the latest example of a fintech start-up seeking a piece of the banks’ lucrative financial relationships with consumers, as the public’s trust in traditional banks wanes. The platform, which has already launched in the United States, will work by allowing customers to essentially download their financial history, […]

RBA study finds cards are king, overtaking cash for the first time

Credit and debit cards have overtaken cash as the most frequently used consumer payment for the first time, as food retailers and ridesharing apps such as Uber offer more cashless payment options. Cards were the most frequently used means of payment, accounting 52 per cent of consumer payments, followed by cash at 37 per cent, according to the Reserve Bank’s consumer payments survey released on Tuesday, which surveyed 17,000 day-to-day payments made by over 1500 participants during a week. A decade ago, cash accounted for nearly 70 per cent of consumer transactions, and cards 26 per cent. The RBA said credit and debit card use increased across the board in […]

Personal loan applications surge as credit cards wane

Australians are shunning high interest credit cards and turning to personal loans for large purchases. Driving the switch are tech-savvy consumers taking up loans from peer-to-peer (P2P) lenders, a new breed of online competitors to banks. Credit card applications fell by almost 4 per cent in the March 2017 quarter compared with the same quarter last year, the latest report on consumer credit by credit bureau Equifax shows. That’s the biggest fall since September 2012 quarter. Personal loan applications rose by 13.5 per cent over the same period, the biggest increase since the March 2005 quarter. The latest period of sustained growth in personal loan applications started in the second […]

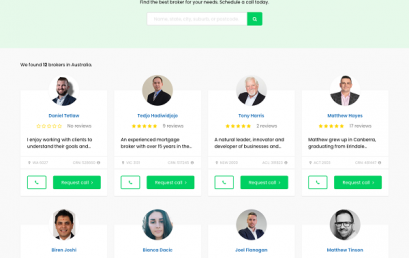

Effi announces new partnership with global comparison site Finty

Effi has announced a partnership with global comparison site Finty, which will enable brokers to reach more potential customers throughout Australia.

Thank You & Merry Christmas!

From the team at Australian FinTech, we’d like to say a massive THANK YOU to everyone who has supported us over the past 12 months.

How the metaverse will reshape money, payments and identity

The real world where payments take place is being augmented by a metaverse which promises to radically reshape the world of payments again.

Two young entrepreneurs take on the Australian domestic payments scene

Kartikeya Dwivedi and Vihan Bawa decided to collaborate on a solution that would reimagine how domestic payments were being done in Australia.